Dating and Trading Rule – Don’t Chase

Don’t chase after dates and stock, both indicate you are too needy.

Consider a law of attraction: If you are successful you will attract success.

Consider a law of neediness: If you are needy, prospective mates run from you, the opposite direction you expect them to go. They can smell you a mile away with or without body scents.

Chasing suggests acting on some uncontrolled urge. If you are going to act, make sure it is reasoned decision, assess the probability of upside potential and manage your risk.

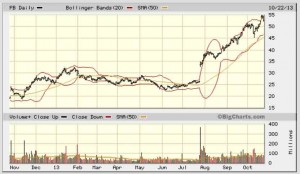

When you buy stocks that have run up a few days and they are extended with giant percentage moves (i.e., to an extreme high above the Bollinger Bands) you are simply buying at a point that is statistically rare. This means the chances are, in time, the stock will tend to revert to the mean and you will lose money.

This could be okay if you took only a small position with the intention of buying more at a more promising point (assuming an uptrend is still intact) usually meaning that the stock drops back down to definite established support levels without breaking down and closing under them.

The problem is often this when you are chasing a stock, you “think” the stock is leaving you behind so you want to expend your capital in what is a desperate move when you have already “missed” a move that others have already profited from.

You end up with a high cost basis and you end up on an emotional roller coaster again wondering if at any moment you are going to have a losing position (you could still put in a stop. Once again, this is not the best way to trade, when you are always in a position to get easily stopped out, which means you are in the habit of losing small amounts but frequently losing small amounts, which will still add up to a whopping amount of money).*

Chasing Relationships

Isn’t this a lot like trying to dating someone who is playing hard to get? You chase them because you cannot help yourself. Or what about chasing after someone who is not even interested in you? This is possibly game playing and you make yourself the token on the game board.

It’s one thing to be assertive and taking the initiative, but it is quite the another to sacrifice your self-respect and your true self (not the foolish one that is chasing).

The kind of person I believe most people want to mate up with carries a sense of self-respect, self-confidence and self-worth. When you meet someone you have a mutual attraction with, you want to share in each other’s strength, not toy with their weaknesses.

Personally, I judge each party equally but in different ways in the chase game. Both have an insecurity in the game playing mode. The chaser has less self-respect than they think and the target has an insecurity that requires others to chase them. Convince me I’m wrong.

Don’t make a habit of chasing. It’s better to wait until the relationship reverts to the mean when they are at a reasonable buy/introduction point where both parties are able to be more honest with each other.

* A notable exception to a break out that tends to be more bullish that normal, and that is when the break out is after a prolonged period of consolidation and especially if the bollinger bands were tight before the breakout.

I’ll see you… on the next page

If you like something about this article, please share and comment.